Want Zero Mortgage Debt?

Higher Rates Can Get You There

(This Info May Blow Your Mind!)

No secret, current rates are higher than they were, but historically pretty good. Buyers are still buying, and owners with great rates are holding or taking equity lines. Whether buying or refinancing, the goal is to pay down as quickly as possible. The question is, if you do not have an abundant amount of cash, is it a good thing to tie up a lot of your hard-earned cash in a home without easy access? ANSWER: It depends.

Have you heard of a “lifestyle loan”? I would surmise most likely not. Why not? I would guess that to “sell” a lifestyle loan takes a lot of time, explanation, questions, and analyses on the part of a loan officer, and… in today’s world, who has the patience for that. In addition, most loan officers never heard of a “lifestyle loan,” and even if they did, it’s not worth their time to offer it because it’s so much easier to “sell” a 30-year fixed or some type of adjustable rate. Much easier to offer” in the box” stuff especially if you get paid the same commission. Keep in mind, standard mortgages give you standard results. The potential for hundreds of thousands of dollars in savings, for the right borrower, exists, when the “lifestyle mortgage” is structured correctly. Yup, you read that correctly, hundreds of thousands of dollars. Definition of the right borrower: A borrower who has consistent predictable cash flow with possible bonuses annually, or any kind of residual depository income.

When it comes to choosing a mortgage, what would you think is cheaper? A mortgage with a lower market rate with a much longer term like a 30-year fixed, or a mortgage with a higher rate, but has a much shorter term? The answer would depend on how the mortgage is structured. Most borrowers, by default, gravitate to wanting to know their interest rate, payment and closing costs, but what’s often missed is analyzing how much they will pay overtime.

The “lifestyle loan” product, I’m referring to, is not a new mortgage product. It was engineered after mortgage products available and mainstreamed throughout western Europe and other countries such as New Zealand, Australia, and Canada and has been available in the United States for a while. Structured correctly, this “lifestyle mortgage” can cut paying down the mortgage by at least 10 years, save a bundle of money, and still give you the flexibility of being able to tap the equity in your home. The overall cost of the mortgage is reduced substantially over time. Once you understand the concept of “rate doesn’t matter, but it’s the cost over time,” you’ll appreciate the benefits of this mortgage.

The longer you stay in debt the more expensive the debt becomes, so shouldn’t the goal be to shorten the life of your debt? Traditional mortgages are rigid. Money goes in, but you can’t take money out. Essentially, you are locked into the mortgage with no flexibility unless you take a home equity line or refinance. It should be a financial goal to shorten the life of a loan and its debt. The” lifestyle loan,” solves all of the above by keeping your money liquid. The structure allows you to direct your salary/bonus/additional income/savings to pay into the mortgage immediately, without changing your budget thereby reducing interest rate costs monthly, annually, and collectively. The intent of the product design is to make it easier for borrowers to reduce the total cost of the mortgage quickly.

What exactly is the “lifestyle loan”?

The mortgage is a first lien home equity line of credit that is used to finance real estate (purchase, or refinance), with a built-in personal checking sweep account that helps people use their idle money to reduce their daily principal balance freely without locking those funds up in the home/mortgage permanently. This makes it a very safe and effective way to reduce the size of the mortgage balance. Interest is recomputed daily giving the borrower a daily interest expense reduction, so they start to cut interest away simply by using the strength of their cash flow. The mortgage has a 30-year draw and provides in and out access of the mortgage for 30 years 24/7. You can freely pay down your principal and take your money right back out. The interest rate is competitive for its product type, and usually higher than a 30-year fixed. It can adjust upward and downward as well after the initial fixed period.

A borrower can pay down the mortgage faster without changing their daily spending, and still have access to the line of credit, so that their able to tap back into it to buy an investment property, or put more money into retirement, pay for school go on vacation etc.…

Just to give you an idea on how it would work let’s use a Purchase Scenario:

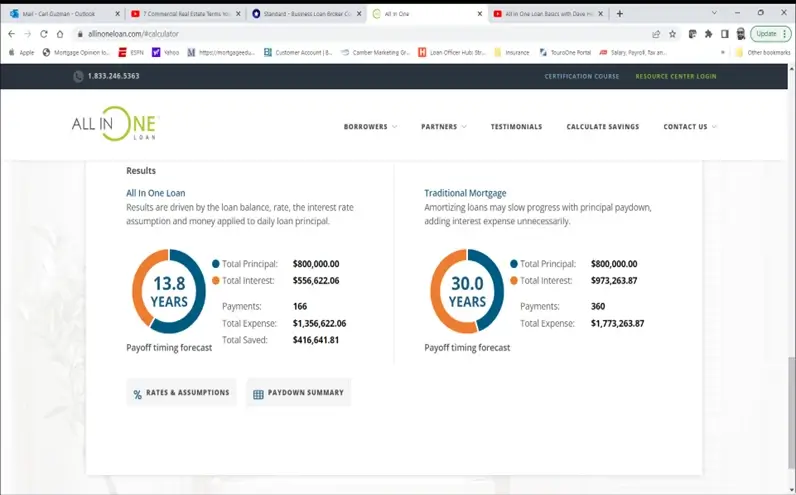

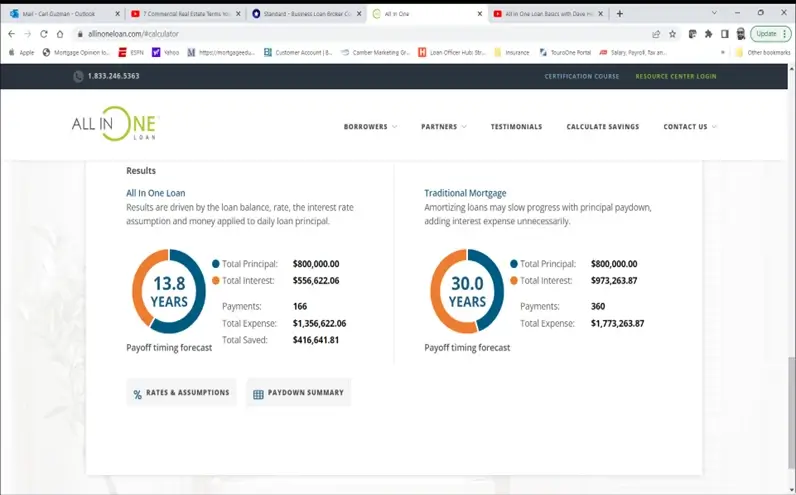

Comparing a standard 30-year fixed rate to the “lifestyle mortgage”

Purchase price: $1,000,000 20% Down Payment, Loan amount $800,000

30 Year fixed rate mortgage Current rate: 6.25 Monthly Mortgage payment $4,925.74

“Lifestyle mortgage”

Rate: based on the CMT index plus a 3.75 margin = 8.46 rate

Monthly deposits into the sweep checking account (usually salary, bonus) $21,666.67 (Total Bi-weekly salary)

Average annual deposits $260,000 ($21,666.67 x 12)

Amount leftover from deposits: 15% $3,250

Results:

Many people will earn more money in just five years than they owe on their mortgage. In general, most people’s salaries flow through their checking account and bills are paid from that account. Residual income, if any, is left dormant. Some may move the excess money to a savings account, but either way these short-term deposit accounts have high volume money activity over time, but pay very little in earned interest. The biggest benefit of a checking account is the secured access to your money. What if that same access to your money was available, within your mortgage, but when you're not using your money, your mortgage principal balance is lowered by the same amount of money you deposited? What if that mortgage recomputed interest daily on that lower balance? Your cash is works for you in the checking sweep account, waiting to be spent on something else tomorrow, next week, next quarter, next year, saving you monthly, annual, and total interest costs. That's how this “lifestyle loan” is engineered to save thousands in interest expense, and lower the time it takes to pay down your mortgage. The biggest cause of interest expense is not necessarily the interest rate, but it's actually the length of time you're in debt.

Mechanically, once the mortgage is set up, there's no extra manual step to do anything. A deposit, salary, bonus, etc... automatically sweeps the money from the checking account. The checking account, at midnight, will show a zero balance. The deposit made earlier that day sweeps over to the first mortgage heloc paying.

down the balance, so you literally wake up the next morning owing a mortgage balance less the amount swept into your account, and consequently less mortgage interest is paid. The lifestyle loan is a simple interest loan. There is no amortization schedule, no predetermined interest cost, and your payment is never structured to where you have to pay a set amount of principal and interest.

If you live within your means, and has some control over your spending, and can qualify for a 30-year fixed mortgage today, and know how to use a checking account, the chances are you'd benefit greatly from this product, and you should be made aware (which you now are after reading this article)) that it exists.

Another feature I want to point out is, G-d forbid, if you lose your job or you get sick and you're out of work for four or five months, in a traditional mortgage, if you can’t make the payment, you’re going to be late on your mortgage payment and may be 90 days from defaulting. A lender or a bank may help, but still there's no automatic safety net built into a traditional mortgage (although you may be able to modify or negotiate a forbearance). With the lifestyle loan, you can’t be “late.” Interest will just calculate until you get back up on your feet. The lifestyle loan is a flexible credit facility that allows you to maneuver through those things without worrying about losing your home or going delinquent on your payment. As long as there's credit available that continues to be made automatically, it's extremely hard to go late on this loan.

Sometimes, ignorance is not bliss. You are officially not ignorant, in this matter, as of now. Be a seeker and save some money.

Carl Guzman, NMLS# 65291, CPA, is the founder and President of Greenback Capital Mortgage Corp. & www.Mortgagegenius.com. He is a Real Estate Mortgage Banker & Business financing expert with over 33 years' experience. He currently has 214 5 star reviews on Zillow. Carl and his team will help you get the best mortgage financing for your situation and his advice will save you thousands! www.greenbackcapital.com ceg@greenbackcapital.com